|

|

![]()

|

NEW TECHNOLOGY – PUNCHED PAPER TAPE |

![]()

|

|

|

|

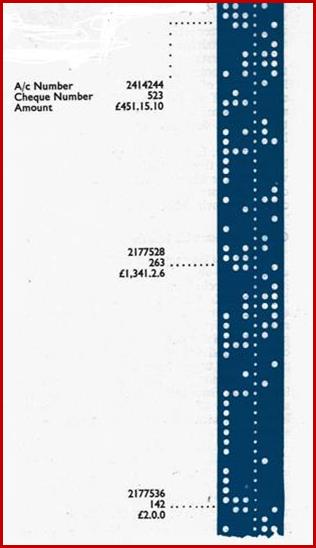

A reel holds 2,400 feet of ½ inch wide

magnetic tape, storing information at 800 characters an inch. A full reel can

hold records for as many as 40,000 current accounts. |

|

|

The Future System This equipment represents the first phase of the full system and

includes high-speed reader/ sorters, each capable of dealing with over a

thousand cheques a minute, reading all the information appearing on the code

line, sorting the cheques by the sorting code number and placing entries into

the current accounts operated by the computer. The three sorters will be installed

in advance of the computer and manual sorting will be transferred to them in

the first instance. This stage, which should be achieved during 1965, will

not greatly alter branch methods, as clearing acknowledgment will continue as

now. The computer itself is unlikely to be installed before the

spring of 1966. Thereafter the effect on the clearing system will be felt as

the computer will control a part of the sorting power and the development of

a fully automatic clearing system will begin. At first the computer will deal

with only a part of the cheque clearing, the rest being sorted without

computer control. The automated clearing system will result in branches

receiving their clearings together with a list produced by the computer so

that reconciliation will not be dependent on the acknowledgment as it is at

present. Simultaneously, the computer will have the power to deal with the

current accounts of thirty-six branches in the London area. When the clearing

cheques arrive at one of these branches they will already have been tested

against the accounts and the branch will be told which cheques are stopped

and which will run an account into debit in excess of the agreed limit. It

will also deal with Registrar's Department accounting and will be able to

make full use of the new type of travellers' cheque and advice, the

reconciliation of which will require the absolute minimum of human

intervention. Thus the first stage of the operation will reduce to modest

proportions the very monotonous hand-sorting of cheques and later will

relieve the clearing staff of the difficulties of reconciling acknowledgments

received back from branches two or three days after the cheques have been

handled. Ultimately, further electronic equipment will be added to the

installation by which time the whole of the clearing will be automated and

computer operation of current accounts will extend to provincial centres. Communication With Branches

Much research has been necessary into processes associated with

computer operation. For instance, the encoding of amounts in E13B characters

to enable the reader/sorter to read automatically all information needed for

current account and clearing operation still presents a number of difficulties

and we are discussing these with manufacturers as well as making trials of

prototype machines produced for such a purpose. Very considerable

difficulties have been experienced in developing a satisfactory method of

personalisation which involves printing on all cheques the account name and

account number, the latter in the special characters suitable for automatic

reading. We have co-operated extensively with one manufacturer in developing

a suitable machine which we are already using experimentally and which we

shall be using for the first branches to be converted to personalisation in

readiness for the London system. We have provided a testing ground for a

service operated by a cheque printer and have carried out tests with other

types of machinery in an attempt to solve this very difficult problem. Problems and

Training There seem to be endless difficulties in the way of such a radical

revolution in banking methods as is now being attempted. It is not sufficient

for us to take the results of our experiences on the present computer and

simply convert these for operation on the new machine: it is important that

we should make full use of the more powerful facilities that will be

available. The new computer will be capable of carrying on more than one

operation at a time: it can print lists or statements at 1,100 lines a

minute, it can read paper tape at 1,000 characters a second and, as an

example of its speed of calculation, it can complete an addition in

1/30,000th of a second. Speed of

calculation is not, however, very significant in this type of bank work;

speeds of addition up to two million a second are practicable with modern

computers but would contribute nothing to our operations.

|

|